This morning the news posted of a major hotel chain merger with Marriott buying out Starwood Hotels in a takeover acquisition. I never saw Marriott International mentioned in 2015 during all the speculation of a Starwood acquisition, but I have felt the chain has been making the most news in the past few years with hotel acquisitions. Starwood Hotels is a huge acquisition for Marriott. Starwood’s nearly 1,300 hotels worldwide will combine with Marriott’s 4,300 hotels to create the largest hotel chain in the world with 1.1 million hotel rooms, the size measure most important to hotel industry analysts. The deal is expected to close in mid-2016.

Marriott Rewards has 54 million members. Starwood Preferred Guest has 21 million members.

It is far too early for anything but pure speculation on the effects to the loyalty programs. SPG will certainly change, since Marriott is unlikely to maintain two separate loyalty programs, but those are all changes we can speculate on through the miles and points blogs for the next few months.

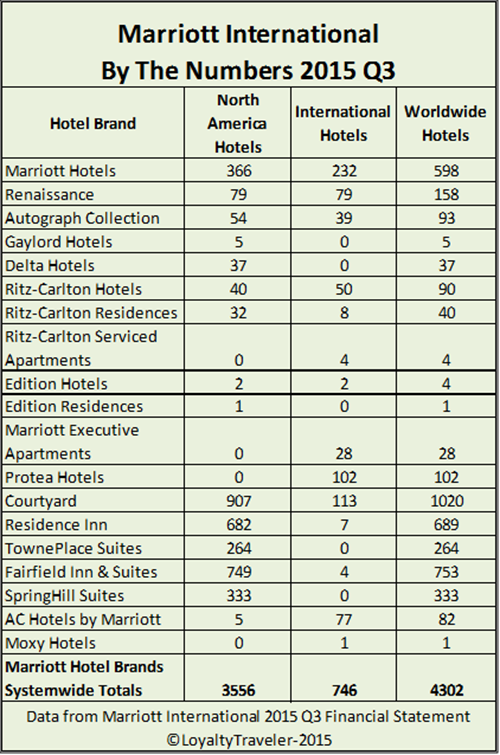

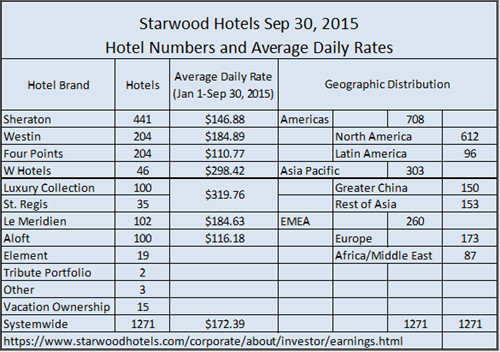

Here are some factual numbers I put together recently on each hotel chain.

Loyalty Traveler – Marriott International hotel brands room rate data 2015 Q3 (Oct 29, 2015).

Loyalty Traveler – Hyatt and Starwood Hotels compared by brand room rates (Nov 5, 2015).

ALL I can say is wow. And I no longer need to bother reaching 500 nights for SPG Lifetime Platinum.

Marriott International Press Release November 16, 2015

Bethesda, MD, and Stamford, CT, November 16, 2015 – Marriott International, Inc. (NASDAQ: MAR) and Starwood Hotels & Resorts Worldwide, Inc. (NYSE: HOT) announced today that the boards of directors of both companies have unanimously approved a definitive merger agreement under which the companies will create the world’s largest hotel company. The transaction combines Starwood’s leading lifestyle brands and international footprint with Marriott’s strong presence in the luxury and select-service tiers, as well as the convention and resort segment, creating a more comprehensive portfolio. The merged company will offer broader choice for guests, greater opportunities for associates and should unlock additional value for Marriott and Starwood shareholders. Combined, the companies operate or franchise more than 5,500 hotels with 1.1 million rooms worldwide. The combined company’s pro forma fee revenue for the 12 months ended September 30, 2015 totals over $2.7 billion.

Transaction Highlights and Strategic Benefits

- Summary of Transaction: Under the terms of the agreement, at closing, Starwood shareholders will receive 0.92 shares of Marriott International, Inc. Class A common stock and $2.00 in cash for each share of Starwood common stock. On a pro forma basis, Starwood shareholders would own approximately 37 percent of the combined company’s common stock after completion of the merger using fully diluted share counts as of September 30, 2015. Total consideration to be paid by Marriott totals $12.2 billion consisting of $11.9 billion of Marriott International stock, based on the 20-day VWAP (volume weighted average price) of Marriott stock ending on November 13, 2015, and $340 million of cash, based on approximately 170 million fully diluted Starwood shares outstanding at September 30, 2015. Based on Marriott’s 20-day VWAP ending November 13, 2015, the merger transaction has a current value of $72.08 per Starwood share, including the $2 cash per share consideration. Starwood shareholders will separately receive consideration from the spin-off of the Starwood timeshare business and subsequent merger with Interval Leisure Group, which has an estimated value of approximately $1.3 billion to Starwood shareholders or approximately $7.80 per Starwood share, based on the 20-day VWAP of Interval Leisure Group stock ending November 13, 2015. The timeshare transaction should close prior to the Marriott-Starwood merger closing.

Total Estimated Value to Starwood Shareholders

Share Price of Marriott International, Inc.

$70.08*

Cash Consideration Per Share

$2.00

Value of Vistana Disposition

$7.80**

Total Value

$79.88

*Marriott 20-day VWAP ending November 13, 2015, calculated at 0.92 of $76.17

**Based on ILG 20-day VWAP ending November 13, 2015. Excludes $132M of cash consideration and reimbursement from ILG to Starwood

After adjusting for the value of consideration to be separately received by Starwood shareholders in the Vistana transaction, the merger consideration represents a premium of approximately 6 percent over the Starwood stock price using the 20-day VWAP ending November 13, 2015 and a premium of approximately 19 percent using the 20-day VWAP ending October 26, 2015 (prior to recent acquisition rumors).

- Leveraging Operating Efficiencies: Marriott expects to deliver at least $200 million in annual cost savings in the second full year after closing. This will be accomplished by leveraging operating and G&A efficiencies.

- Accretive to Earnings: Marriott expects the transaction to be earnings accretive by the second year after the merger, not including the impact of transaction and transition costs. Earnings will benefit from post-transaction asset sales, increased efficiencies and accelerated unit growth.

- Significant Capital Recycling Program: Marriott expects Starwood to continue its capital recycling program, generating an estimated $1.5 to $2.0 billion of after-tax proceeds from the sale of owned hotels over the next two years. The hotels are expected to be sold subject to long-term operating agreements.

- Continued Strong Returns to Shareholders: On a pro forma combined basis, Marriott and Starwood generated $2.7 billion in fee revenue in the 12 months ending September 2015. In 2015, Marriott expects to return at least $2.25 billion in dividends and share repurchases to shareholders. Marriott believes it can return at least as much in the first year following the merger.

- Accelerated Global Growth: Marriott International expects to accelerate the growth of Starwood’s brands, leveraging Marriott’s worldwide development organization and owner and franchisee relationships. The combined company will have a broader global footprint, strengthening Marriott’s ability to serve guests wherever they travel.

- Lifestyle Leader: Starwood’s first-mover advantage in the lifestyle category, along with Marriott’s broad range of brands in this segment, positions the combined company as a leader in the lifestyle space. With Marriott’s strong owner and franchisee relationships, the combined company expects growth of its lifestyle brands to accelerate.

- World-Class Associates: This combination brings together two of the most talented teams in the industry. Together, they will combine their innovative ideas and service commitment to deliver unforgettable guest experiences.

- Leading Loyalty Programs: Today, Marriott Rewards, with 54 million members, and Starwood Preferred Guest, with 21 million members, are among the industry’s most-awarded loyalty programs, driving significant repeat business. They should be even stronger when the companies merge.

- Owner and Franchisee Preference: The combined company will be able to realize increased efficiency by leveraging economies of scale in areas such as reservations, procurement and shared services. Combined sales expertise and increased account coverage should drive additional customer loyalty, increasing revenue. We expect that these enhanced efficiencies and revenue opportunities should drive improved property-level profitability as well as greater owner and franchisee preference for the combined company’s brands.

- Commitment to Management and Franchising: Marriott remains committed to its management and franchise strategy, minimizing capital investment in the business to generate attractive shareholder returns.

Arne Sorenson, President and Chief Executive Officer of Marriott International, said: “The driving force behind this transaction is growth. This is an opportunity to create value by combining the distribution and strengths of Marriott and Starwood, enhancing our competitiveness in a quickly evolving marketplace. This greater scale should offer a wider choice of brands to consumers, improve economics to owners and franchisees, increase unit growth and enhance long-term value to shareholders. Today is the start of an incredible journey for our two companies. We expect to benefit from the best talent from both companies as we position ourselves for the future. I know we’ll do great things together as The World’s Favorite Travel Company.â€

J.W. Marriott, Jr., Executive Chairman and Chairman of the Board of Marriott International, said: “We have competed with Starwood for decades and we have also admired them. I’m excited we will add great new hotels to our system and for the incredible opportunities for Starwood and Marriott associates. I’m delighted to welcome Starwood to the Marriott family.â€

Bruce Duncan, Chairman of the Board of Directors of Starwood Hotels & Resorts Worldwide, said: “During our comprehensive review of strategic and financial alternatives, it was clear that our talented people, world-class brands, global leadership and spirit of innovation were much admired and key drivers of our value. Our board concluded that a combination with Marriott provides the greatest long-term value for our shareholders and the strongest and most certain path forward for our company. Starwood shareholders will benefit from ownership in one of the world’s most respected companies, with vast growth potential further enhanced by cost synergies. Starwood’s shareholders will also receive the value of the previously announced sale of our vacation ownership business to Interval Leisure Group, which is not part of this transaction.â€

Adam Aron, Starwood Hotels & Resorts Worldwide Chief Executive Officer on an interim basis, said: “We are excited to play a vital role in the creation of the biggest and best hotel company in the world with tremendous upside potential. The combination of our two companies brings together the best in innovation, culture and execution. Our guests and customers will benefit from so many more options across 30 hotel brands, while our hotel owners and franchisees will derive value from our combined global platform and efficiencies. We are also delighted that our associates will have expanded opportunities as part of a larger organization that is consistently recognized as one of the best companies to work for in the world.â€

One-time transaction costs for the merger are expected to total approximately $100 to $150 million. Transition costs are expected to be incurred over the next two years. They cannot be estimated at this time, but are expected to be meaningful.

Marriott will assume Starwood’s recourse debt at the closing of the transaction. Marriott remains committed to maintaining an investment grade credit rating and to continue managing the balance sheet prudently after the merger. Marriott expects to maintain our 3.0x to 3.25x adjusted debt to adjusted EBITDAR target.

Arne Sorenson will remain President and Chief Executive Officer of Marriott International following the merger and Marriott’s headquarters will remain in Bethesda, Maryland. Marriott’s Board of Directors following the closing will increase from 11 to 14 members with the expected addition of three members of the Starwood Board of Directors.

The transaction is subject to Marriott International and Starwood Hotels & Resorts Worldwide shareholder approvals, completion of Starwood’s planned disposition of its timeshare business, regulatory approvals and the satisfaction of other customary closing conditions. Assuming receipt of the necessary approvals, the parties expect the transaction to close in mid-2016.

3 Comments

Comments are closed.