We all know who the winners are in revenue-based frequent flyer programs – travelers who spend the most. The changes for US members of Delta Skymiles and United Mileage Plus revenue-based miles earning means travelers who fly on low fares are the losers.

PwC published a research report: Aviation perspectives The future of frequent flyer programs: Will you win or lose?, which quantifies the effect of revenue-based flyers. The results are a fascinating analysis of data for loyalty travelers.

Revenue-based loyalty earning rewards flyers based on how much they spend rather than how much they fly. Delta Skymiles and United Mileage Plus adopted these policies for 2015.

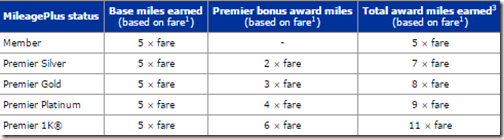

United Mileage Plus Earning Miles

On top of United Mileage Plus revenue-based miles earning is a minimum spend requirement to reach elite tiers. This change adds to the difficulty of earning bonus miles through elite membership when flying primarily on low fares.

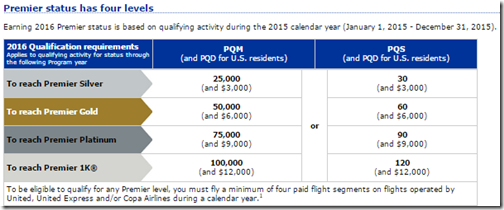

U.S. resident Mileage Plus members must spend $3,000 in addition to flying 25,000 Premier Qualifying Miles (PQM) in 2015 to earn Premier Silver status.

This past week has seen many low fares from San Francisco and Los Angeles to Scandinavia on United Airlines. Two round trip flights from San Francisco to Stockholm via New York is 25,980 miles.

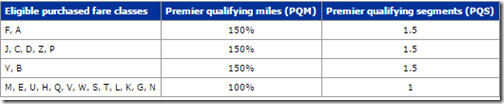

Flying United Airlines for around $609 for April and May 2015 travel to Stockholm booked in K fare class earns 100% PQM credit. This means the U.S. resident Mileage Plus member earns over 25,980 PQM for two economy roundtrip flights to Sweden, but the PQD requirement is not met with only $1,218 spent on for two San Francisco to Stockholm roundtrip tickets.

These United Mileage Plus changes have had an effect on Mileage Plus members in 2015. PwC analyzes this effect in its report.

Here are some data points I lifted from the PwC report.

- 58% of passengers fly U.S. major airlines (United, Delta, American).

- 32% fly LCC low cost carriers (Southwest, JetBlue, Spirit, Frontier).

- 10% fly non-aligned airlines defined as non-LCC carriers that are not part of an alliance (Alaska, Hawaiian).

- 82% of passengers pay less than $300 per one-way flight.

- 71% of passengers flying more than 2,500 miles one-way are negatively impacted by earning at least 500 fewer miles for their flight in the revenue-based system.

- Passengers flying on tickets with stops are more negatively impacted by reduced miles earning. 70% of passengers fly nonstop routes and only 1% fly two-stop routes.

- The airlines’ balance sheet liability for frequent flyer miles not redeemed is around $100 billion worldwide for 10 trillion outstanding miles in member accounts.

- 7% of airline miles flown are with frequent flyer award tickets.

- Passengers flying long distance flights on low fares are the most negatively impacted group in revenue-based earning.

Passengers flying long distance on discounted fares are much worse off in spend-based FFPs, indicating a desire by airlines to end the common practice of ‘mileage runs,’ which are discounted fare flights taken specifically to gain reward points.

PwC – Aviation perspectives The future of frequent flyer programs: Will you win or lose?

Read the PwC report for graphs illustrating the breakdown of miles earned by fare paid showing positive and negative impact on miles earned.

Bottom line is the airline revenue-based miles earning system redistributes benefits from low-revenue customers to higher revenue customers. One of the conclusions of the PwC report is airlines maintaining a miles-based frequent flyer program may have a competitive advantage.

That scenario should play out in 2015 as we see the impact of United and Delta revenue-based programs compared to American Airlines still operating as a miles-based frequent flyer program.

Another potential bombshell waiting to drop for frequent flyers is the possibility that major airlines will also move to dynamic redemption, whereby all reward tickets are pegged to a fixed price for miles. This means a $300 ticket might cost 25,000 miles and a $600 ticket is 50,000 miles. Many low cost carriers already operate this kind of system.

A central problem with moving to a dynamic redemption model is that it reduces ‘reward aspiration’—the idea that one can accumulate points to cash them in for an expensive flight to a vacation spot far from home that one might not have been able to purchase with cash. For many, it is this potential to maximize the value of award points beyond their perceived cash value that motivates their flying behavior and willingness to spend on accrual flights.

PwC

Dramatic changes have taken place in frequent flyer programs for 2015. This will be an interesting year to watch and see how the revenue-based mileage earning systems fare for United and Delta compared to the traditional flight miles earning system still in play for American AAdvantage members.

7 Comments

Comments are closed.