Over the past decade there have been legal claims filed in many states charging the OTA hotel room sellers are not paying their fair share of hotel taxes to the states for rooms sold on the travel websites.

Expedia, Priceline and other OTAs apparently pay hotel tax in most states only on the negotiated rate they have with the hotel rather than the rate the hotel room is sold to the consumer. The negotiated discount between an OTA and the hotel is generally 15% to 30% of the room rate displayed. This means the OTA is paying hotel tax to the state on a lower room rate than when the hotel sells directly to the consumer through a site like Hilton or Marriott.

States like New York and North Carolina have passed legislation requiring payment of taxes on the full room rate charged to the consumer. In South Carolina and Georgia the state supreme courts have ruled taxes are due on the full hotel rate charged by OTAs to the consumer.

Link: Bloomberg News – Expedia to Priceline Targeted as States Cry for Revenue: Taxes

Expedia makes most of its profits from hotel room bookings

Expedia gets a larger share of its profits from hotel room bookings compared to airlines. Forbes estimates 70% of Expedia’s valuation is based on its hotel room sales.

The basic model for online travel agencies (OTAs) selling hotel rooms is a negotiated discount price between the OTA and the hotel or hotel chain. The room rates on OTA sites like Expedia are generally the same or higher than the rate for the same room on the hotel chain websites for Marriott, Starwood, Hyatt and other hotel brand sites.

Best Rate Guarantee policies for the major hotel chains like Hilton, Marriott, and IHG offer the consumer discounts, cash, or a free night for a verified claim when a lower rate is found on an OTA for the same room. The hotel chains prohibit OTAs from undercutting their rates posted on the hotel brand websites. This price-fixing scheme between OTAs and hotels has been the center of a lawsuit in the UK. Related link to the UK story: Loyalty Traveler August 9, 2013 – UK ruling may impact hotel chain BRG claims.

Still, OTAs sometimes have lower rates for the same room. About one out of every four hotel stays I booked in the past year were approved through a hotel chain’s Best Rate Guarantee claim when I found a lower rate on an online travel agency site like Expedia or hotels.com than the rate displayed on the hotel brand website.

How much tax money are we talking about? Tens of Millions of dollars.

For an example accounting of the OTA tax issue on hotel rooms, assume a $100 hotel room rate booked on Hilton’s website will result in hotel tax being paid on a $100 rate (generally 8% to 20% depending on state and city).

However, that same room rate of $100 charged to the consumer for a hotel booked through a site like Expedia with a negotiated discount rate will result in hotel tax being paid on only $70 to $85 for the $100 room rate the consumer pays to Expedia.

The OTAs claim they only need to pay tax on their negotiated rate with the hotel and not the rate the consumer ultimately paid for the room. This might not seem like a large amount of money, but keep in mind that about half of all hotel rooms are booked through OTA sites and Expedia’s overall hotel bookings grew in the US and worldwide this past year and amount to billions of dollars in hotel booking sales.

- Robust growth in global hotel room nights led to a 24% annual increase in s Q1 2013 revenues (>$1 billion), and though Expedia faced some weakness in demand from Southern Europe, its global performance remains strong.

- While the domestic room nights grew by 15%, international bookings marked 43% y-o-y growth.

In addition to accounting for the majority of its revenues (>70%), hotel bookings is also the most profitable division with revenue margins of approximately 20% compared to 2% and 9% from airline booking and car rentals & cruise bookings, respectively.

Forbes April 26, 2013 – Hotel Bookings Fuel Expedia’s Growth But Costs a Worry.

A closer look at booking a hotel room:

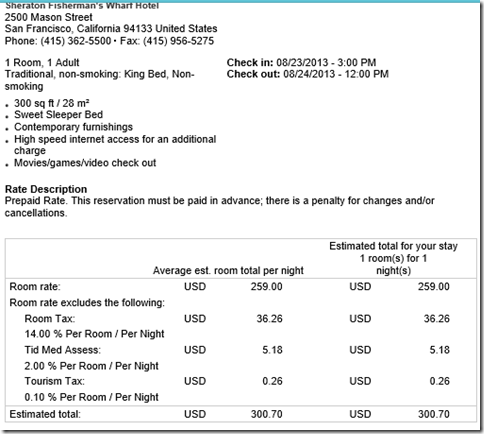

Sheraton Fisherman’s Wharf, San Francisco on Expedia and Starwood sites

I picked one hotel at random to look at how Expedia displays the rate compared to the Starwood Hotels site for the Sheraton Fisherman’s Wharf hotel in San Francisco.

Starwood Hotels site:

Friday, August 23, 2013 = $259 Traditional King

Starwood website display of Hotel Taxes

Starwood calculates 16.1% in State and local taxes and fees = $41.70.

Expedia.com site:

The room rate is the same rate at $259 per night on Expedia.

Expedia taxes and fees total $40.67. This $1.03 difference gives an overall lower rate to the consumer booking the room on Expedia.

If you are not into hotel loyalty programs, then which website are you going to use to book the hotel room?

$299 on Expedia looks better than $300 per night on Starwood.

And this rate discrepancy of $1.03 will not qualify for a Best Rate Guarantee claim with Starwood Hotels.

Booking fees, extra adult fees, fees for children, rollaway charges will be included in the rate comparison. Taxes, gratuities, or any mandatory charges that may apply at Starwood Hotels (e.g., resort charges) will be excluded from the rate comparison.

The estimated value of value-added amenities (e.g.,free breakfast, tickets, gas coupons) offered as part of a Competing Rate will be excluded from the rate comparison, and will not be provided by Starwood when honoring a lower rate.

Starwood may deny claims where the difference between the Competing Rate and the rate on the Starwood Website is less than one percent.

Hotel bookings in the U.S. are up 15% for Expedia in 2013. International bookings are up over 40%.

Is that bridge getting built?

What the consumer generally does not know is Expedia collects $300 for a room and they might only pay $220 back to the hotel based on their negotiated discount rate.

And Expedia might only pay 16% tax on the $220 hotel room sale = $35.20.

Expedia might make $44.47 profit on the transaction for one room night in San Francisco.

The taxes lost to the city and state = $6.50 on this one room night.

Multiply the lost hotel taxes revenue over millions of room nights and that is significant pocket change. This is tax revenue for cities and states needed to fund schools, police, firefighters, roads, bridges and more.

Expedia had net revenue over $1 billion in just Q1-2013.

Like comedian Lewis Black said on the MSNBC Lawrence O’Donnell show last night.

“It’s a privilege to pay taxes. It is not a political question cause we have to pay for stuff.”

And the ironic thing is when I looked up the Lewis Black online video on MSNBC I had to wait 15 seconds for this Travelocity commercial to play out advertising 50% off hotels this Labor Day.

Ric Garrido, writer and owner of Loyalty Traveler, shares news and views on hotels, hotel loyalty programs and vacation destinations for frequent guests.

Follow Loyalty Traveler on Twitter and Facebook and RSS feed or subscribe to a daily email newsletter on the upper left side of this page.

9 Comments

Comments are closed.